Rather, the phone business helps to make the deal totally on their own. You’ll be able to down load PayViaPhone’s app from the Google Play Shop or Application Shop. After that, you’ll want to perform a merchant account manageable build in initial deposit. You may then put a favourite shell out-by-mobile casino program for smooth and you may problem-100 percent free dumps, which will be placed into your cellular telephone costs. Particular shell out by mobile web sites establish payments thru Texts as a result of an excellent third-people payment chip.

Press this link: Promote the fresh view just before depositing

- Particular banks also can enables you to fool around with a great QR password in your banking app.

- Other commission versions, such as currency purchases or worldwide checks, is almost certainly not recognized to have mobile deposit at the financial.

- Think of, you might like to generate oneself a simple take a look at out of a different membership and you will put you to definitely into your online bank account.

- Hold on to the search for a bit before financing was correctly wired in the checking account.This can as well as help obvious any queries the bank could possibly get inquire regarding your credibility of the view.

- The organization costs your a small payment to have this, nevertheless payment most likely is not as much as gas and you will vehicle parking do costs to take they to your jail personally.

Be sure to verify where you would want the amount of money transferred. If you have numerous bank account that have a loan company, you’ll be able to select your own attraction away from a fall-down selection. Some financial institutions and borrowing from the bank unions ensure it is a mobile deposit of someone else’s consider (known as a third-people take a look at), while some exclude it (as well as Financial out of The united states and you can You.S. Bank). Of many banking institutions give mobile view deposit, and Ally Lender, Lender from America, Funding You to definitely, Chase, Citibank, Come across, PNC Bank, U.S. Lender, and you can Wells Fargo.

It will require Prolonged to have Fund to hit Your account

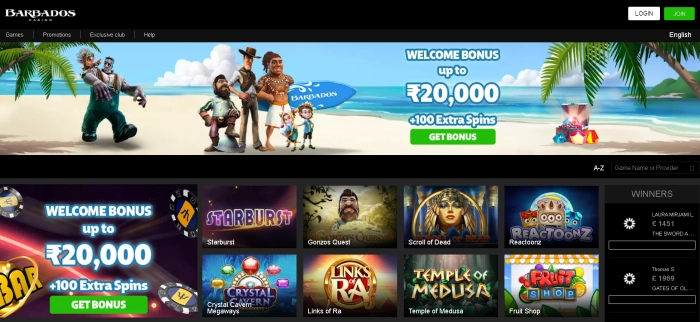

Or even wanted casino debts to look on your financial account/cards (but never head them getting on your own cellular phone bill!), you are obligated to embrace it as in initial deposit alternative. Spend because of the cell phone from the casinos on the internet can be always generate places. As opposed to a bank checking account or charge card, you could make in initial deposit using your current label borrowing. The main advantageous asset of this technique is you do not you would like credit cards otherwise a checking account to help you enjoy in the an on-line casino. Far more convenient than dollars and you may checks — cash is deducted straight from your company savings account.

Be sure you know the terms of the new put, have them in writing, and simply consider a deposit while you are press this link dedicated to to find the automobile. Making a deposit sells a danger of a major losses, but often it is to their benefit to set aside the fresh vehicle. To possess a deposit to be wise, you must be really particular you are prepared to find the brand new automobile.

With regards to the bank, money transferred thru mobile cheque deposit is generally readily available right since the following day. Financial institutions has financing availability regulations you to definitely determine how long it needs to possess a cheque to clear. Specific financial institutions, including, will make the main cheque available immediately, with the rest readily available the following working day.

As previously mentioned above, just because your put a check through your bank’s cellular application doesn’t imply you can place out of the consider. Whether or not your mobile put seems to come off as opposed to an excellent hitch, it can remain best if you retain the newest papers consider just after they clears, and when there’s a challenge later. To possess a mobile take a look at deposit becoming canned, it has to be appropriately endorsed. For individuals who’lso are not following the laws—signing they and you can composing some kind of “for mobile deposit just” on the back—then indeed there’s a chance the fresh put was refused. You’d must redeposit the new consider, that will increase the wishing day until they clears their account.

Second, go into the wished deposit matter and you will proceed with the on the-monitor recommendations to complete the transaction. Because it’s a good prepaid service strategy, you won’t have the ability to withdraw on the Paysafecard just yet. Pages can create Paysafecard accounts and you can finest upwards its balances having coupons. But also for now, online casinos don’t help Paysafecard withdrawals. This is an excellent prepaid means which allows you to deposit at the casinos. A life threatening benefit of Paysafecard would be the fact people don’t must connect bank accounts otherwise handmade cards to make use of it.

The brand new ‘Newly opened’ loss, at the same time, can tell you the fresh of those websites. These are usually just getting started and may also features several juicy offers to benefit from, whether or not they could not have a score yet ,. The new ‘All’ tab next to it can set up a complete set of sites, whenever chosen. And then make a PIN Debit put by the mail, make out a check or money acquisition and make certain to help you include the inmate label/ID and you can studio name. AdvancePayTo generate an enthusiastic AdvancePay payment from the post, make-out a otherwise money buy payable in order to “AdvancePay Service Agency” and make certain to incorporate your bank account matter. You are enjoying Cost and you will Terms & Standards relevant to help you your state aside from your geographical area.

When you attend go into the take a look at, the newest application will show you the most you might put. If you want to deposit a cost that is more than the brand new restrict, check out a branches otherwise ATMs. Definitely maintain your register a safe area until you understand the complete deposit count listed in your account’s earlier/recent deals. Comment every piece of information you published to make certain that it’s precise. Fill in your own view and you may wait for confirmation to see if it’s acknowledged.

Qualification for PNC Secluded Deposit is at the mercy of financial recognition. PNC Remote Put eliminates the need to transport papers checks in order to the brand new part and you will utilizes research signal to help you PNC. The system inhibits numerous places away from a check, as a result of backup recognition, and will be offering users having a few degrees of shelter, to aid leave you satisfaction. Keep an eye on which local casino, as it may establish shell out because of the cell phone costs put alternatives inside the future, therefore it is a far more attractive option for mobile gamers. Bitcoin, Ethereum, or other cryptocurrencies is an alternative age of digital money one to particular casino operators is looking at. But not, Us casinos mostly stop offering such percentage steps owed they within the-county regulations.

How to find out if debt institution also offers mobile cheque deposit is to cheque your own banking software otherwise name the lending company or credit connection. There are many factors you might make use of bank’s cellular cheque put feature, starting with convenience. Deposit cheques with your mobile device is generally much more available and you will less time-drinking than just operating to help you a branch otherwise Atm.

Cellular take a look at depositing allows a customer to store efforts from the deposit a from another location on their smartphone thanks to a great bank’s cellular application. To have shelter reasons, of several banks limitation the amount you could deposit remotely. See what your financial’s everyday and you can month-to-month cellular put restrictions are, following concur that your own view number is actually the individuals limitations.